income tax rates 2022 south africa

18 of taxable income. Effects of reduced corporate income tax rate on investors in REITs.

How Money Supply And Demand Determine Nominal Interest Rates Interest Rates Intrest Rate Rate

R337 801 R467 500.

. Tax rates are proposed by the Minister of Finance in the annual Budget Speech and fixed or passed by Parliament each year. Yolandi is responsible for the interpretation and implementation of tax and labour law requirements for Sage HR Payrolls products in South Africa and Africa. Individuals Comparisons of the average income tax rates for the 2020 and 2022 tax years.

Tax calculator 2023 current Tax calculator 2022. R 38 916 26 of amount above R 216 200 R 337 801 R. The below table shows the personal income tax rates from 1 March 2022 to 28 February 2023 for individuals and trusts in South Africa.

The reduction in the corporate income tax rate would be paid for with the introduction of measures to broaden the tax. Bonus included in salary. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

If you are looking for an alternative tax year please select one below. Fortnightly Tax Deduction Tables. The Minister of Finance in February 2021 announced that the corporate income tax rate would be reduced to 27 from 28 for companies with years of assessment beginning on or after 1 April 2022.

You are viewing the income tax rates thresholds and allowances for the 2022 Tax Year in South Africa. 33 Trusts other than special trusts 23 February 2022 N o changes from last year. For taxpayers aged 75 years and older this threshold is R143 850.

Taxable Income R Rate of Tax R 1 91 250 0 of taxable income. Taxable income R Rates of. Your 2021 Tax Bracket to See Whats Been Adjusted.

R216 201 R337 800. 2022 Tax Calculator 01 March 2021 - 28 February 2022 Parameters. Information is recorded from current tax year to oldest eg.

Travel allowance included in salary. 18 of taxable income. Foreign resident companies which earn income from a source in South Africa.

2023 2022 2021 2020 2019 2018 2017 2016 2015 etc. Daily Weekly Monthly Yearly. 1 March 2020 28 February 2021.

South African finance minister Enoch Godongwana will table his first national budget on 23 February. YourTax Tax calculator Compare yearly tax changes. 365 001 550 000 19 163 21 of taxable income above 365 000.

18 of taxable income. South African Individual Taxpayers. Income tax tables with rebates and car allowance fix cost tables for the 2022 tax year as provided by SARS.

40680 26 of taxable income above 226000. 2023 tax year 1 March 2022 28 February 2023 23 February 2022 See the changes from the previous year. The Personal Income Tax Rate in South Africa stands at 45 percent.

2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa. Its so easy to use. Taxable Income Tax Rate.

On this page you will see Individuals tax table as well as the Tax Rebates and Tax Thresholds scroll down. 1 March 2021 28 February 2022. In this section you will find the tax rates for the past few years for.

Ad Compare Your 2022 Tax Bracket vs. 73726 31 of taxable income above 353100. Monthly Tax Deduction Tables.

Year ending 28 February 2022. R 216 201 R 337 800. The 2022 draft Rates Bill was first published on Budget Day 25 February 2022 and gives effect to the tax proposals announced in Chapter 4 of the 2022 Budget dealing with changes to the rates and monetary thresholds to the personal income tax tables and increases of the excise duties on alcohol and tobacco.

Under 65 Between 65 and 75 Over 75. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate of tax R0 R216 200 18 of taxable income R216 201 R337 800 R38 916 26 of taxable income above R216 200. Year of assessment Rate of Tax.

550 001 and above 58 013 28 of the amount above 550 000. Discover Helpful Information and Resources on Taxes From AARP. Rate of tax R R1 R216 200.

Rates of tax R R 1. 2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. Progressive tax rates apply for individuals.

R70 532 31 of taxable income above R337 800. The amount above which income tax becomes payable is R128 650. Income tax rates home office regulations and unemployment.

Personal Income Tax Rate in South Africa averaged 4124 percent from 2004 until 2020 reaching an all time high of 45 percent in 2017 and a record low of 40 percent in 2005. 1 March 2022 28 February 2023. For the 2021 year of assessment 1 March 2020 28 February 2021 R83 100 if you are younger than 65 years.

Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year. Personal income tax rates. See more tax rates here.

Annual Tax Deduction Tables. Other employment tax deduction tables -No changes from last year. For Individuals Trust.

91 251 365 000 7 of taxable income above 91 250. Quick Tax Guide 202223 South Africa 3 Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2023 Taxable income Rate of tax R0 R226 000 18 of taxable income R226 001 R353 100 R40 680 26 of taxable income above R226 000 R353 101 R488 700 R73 726 31 of taxable income above R353 100. The same rates of tax are applicable to both residents and non-residents.

Sage Income Tax Calculator. R 0 - R 216 200. The rates for the tax year commencing on 1 March 2022 and ending on 28 February 2023 are as follows.

Reduction in corporate income tax rate and broadening the tax base. Tax rates from 1 March 2021 to 28 February 2022. However the rate reduction has yet to be enacted.

This page provides - South Africa Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar. The current tax year 1 March 2022 to 28 February 2022 in South Africa is called the 2022 tax year because the tax year is named by the year in which it ends. 2021 1 March 2020 28 February 2021 Weekly Tax Deduction Tables.

R38 916 26 of taxable income above R216 200. Non-residents are taxed on their South African sourced income. If you are 65 years of age to below 75 years the tax threshold ie.

The 2022 budget speech delivered 23 February 2022 announced that the corporate income tax rate would be reduced to 27 from 28. Years of assessment ending on any date between 1 April 2022 and 30 March 2023. Calculate how tax changes will affect your pocket.

How To File Your Income Taxes In South Africa Expatica

How Do Corporate Taxes For Small Businesses Vary Around The World Vivid Maps In 2022 Small Business Tax Business Tax Small Business

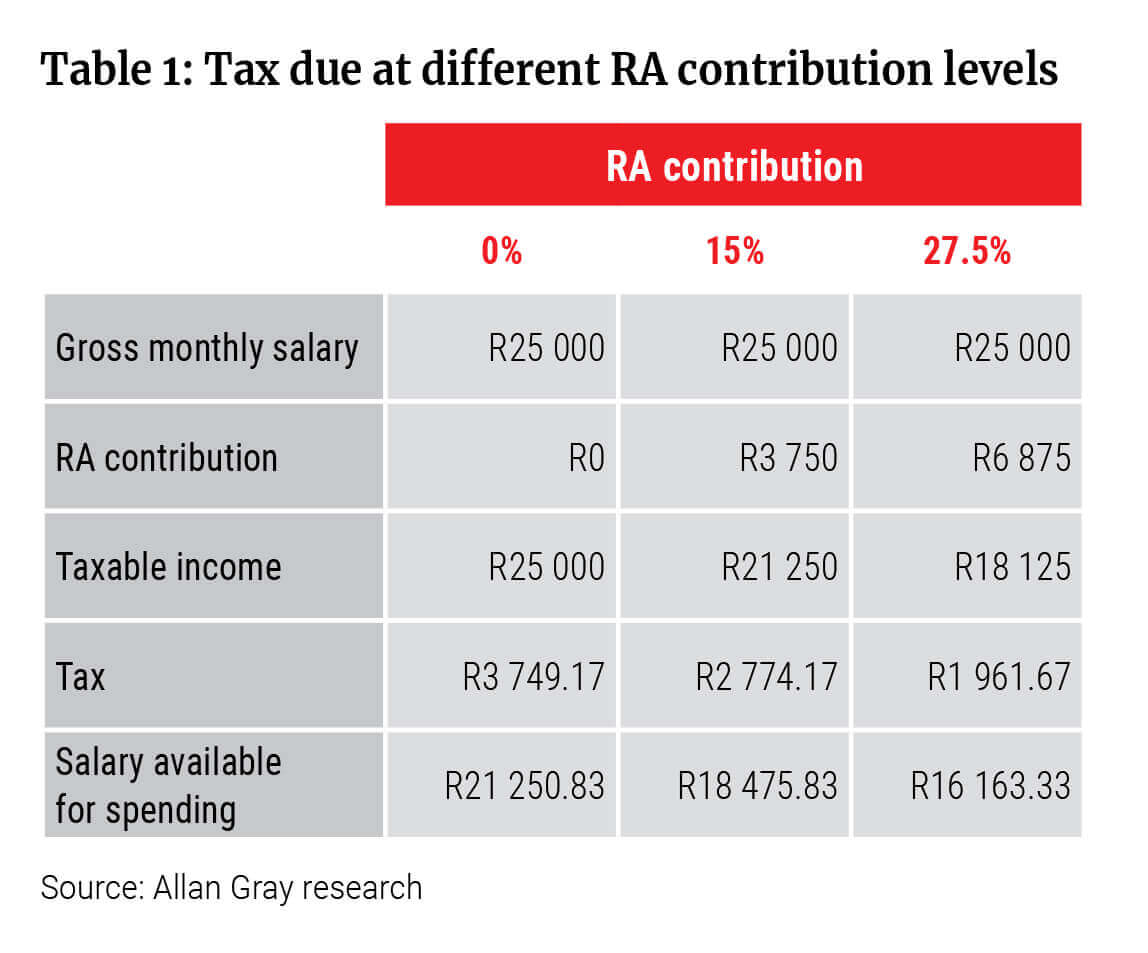

Allan Gray Part 3 How To Maximise Tax Benefits Before The End Of The Tax Year

Top 10 Highest Paid Professions Jobs In South Africa 2022

Trackers Are Becoming Mandatory As Hijacking Trends Shift In South Africa Cars In 2022 South Africa Tracker Africa

Average Income Tax Rates Comparisons South African Revenue Service

Annual Report Template Word Professional Resume Examples For Corporate Jobs Beautiful Gallery Cfo Resume Best Templates Ideas

Corporate Tax In South Africa A Guide For Expats Expatica

State Corporate Income Tax Rates And Brackets Tax Foundation

South Africa Average Monthly Earnings 2015 2020 Statista

Average Income Tax Rates Comparisons South African Revenue Service

How To File Your Income Taxes In South Africa Expatica

Nice Map Of Vanderbijlpark Amazing Maps Map Circular Pattern

When Do You Need An Accountant Accounting Do You Need Ppt Presentation

What Is The Average Salary In South Africa For 2022

Best Tax Software For Small Businesses In 2022 Filing Taxes Tax Return Tax Software

Mdda Opens 2021 22 Call For Grant Funding Applications Business Grant Business News

Whatsapp Introduces Live Location Sharing In South Africa This Is How To Use It